About Us

About Us

H.E. Mr. Khalifa Jassim Al-Kuwari served as the Director General of the Qatar Fund for Development, where he spearheaded the State of Qatar’s efforts in foreign aid and international development. In this capacity, he facilitated the distribution of loans and grants to both developing nations and international organizations. Since 2014, he led the establishment, strategy-setting, operationalization, partnerships, and funding programs of the Qatar Fund for Development in various developing countries.

Previously, H.E. Mr. Al-Kuwari was the Chief Operating Officer of the Qatar Investment Authority (QIA), where he oversaw the entire business support infrastructure and led several initiatives to improve the performance of support functions. Prior to that, H.E. Mr. Al-Kuwari was the QIA Executive Director of Joint Venture and International Business, where he managed the investment joint ventures and government-to-government relations. H.E. has been appointed to the boards of leading companies and institutions such as Harrods, Volkswagen Group, Fairmont Raffles Group, Songbird Real Estate, Qatar Exchange, Katara Hospitality, and Mowasalat. He was also appointed Chairman of the Board of Directors of the Islamic Bank of Britain, and Qatar and Algeria Investment. Additionally, H.E. is the head of the Audit Committee and a member of the Board of Directors at Qatar Mining Company.

H.E. is also interested in social work within the State of Qatar and was elected to the Board of Directors of Qatar Foundation for Social Work, which includes social institutions such as Nama, Ehsan, Shafallah, Dreama, Wifaq, and Aman. H.E. Mr. Khalifa Jassim Al-Kuwari serves as the Chairman of the Qatar Academy for Science and Technology (QAST) Board of Advisors and holds membership on the Advisory Board at the Center for Conflict and Humanitarian Studies, and he is the Vice President of the Qatar University Alumni Association. H.E. Mr. Al Kuwari also served as the president of the first Qatar Leadership Centre Alumni Association Council.

H.E. Mr. Al-Kuwari started his career as an accountant and investment manager and handled various responsibilities at the Qatar Central Bank and Public Works (Ashghal) & Urban Planning Authority. He acquired in-depth experience in accounting, auditing, financial analysis, and investment management.

His Excellency Mr. Al-Kuwari holds an Executive MBA in Business Administration from the London Business School in UK, an MBA in Accounting from Cleveland State University in the USA and a Bachelor of Business Administration from Qatar University. He graduated from the Leadership Development Program at Harvard Business School in the USA and Qatar Leadership Center. Mr. Al-Kuwari also passed the Chartered Accountants' Examination in Ohio, USA.

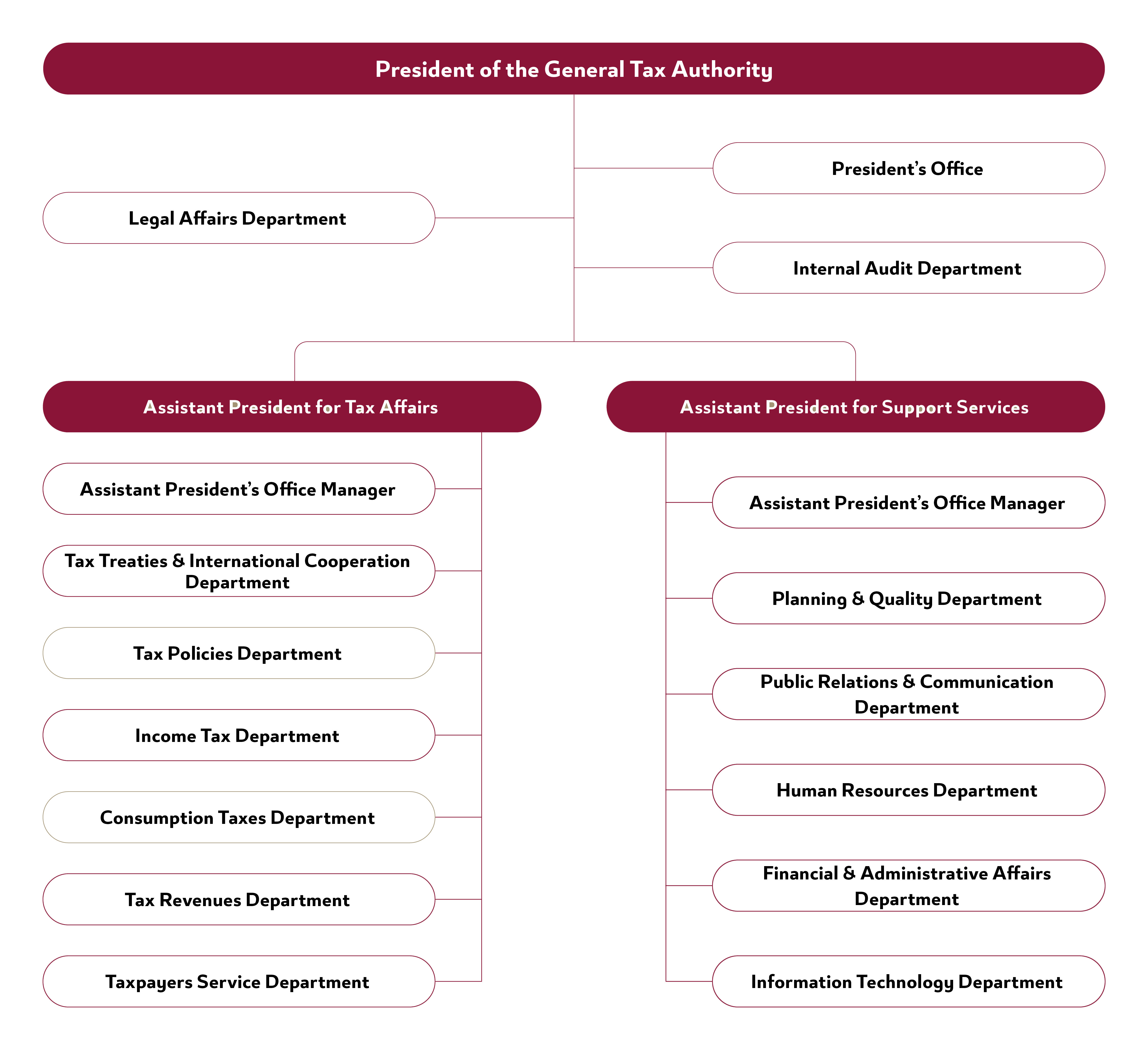

The General Tax Authority was established based on Amiri Decision No. 77 of 2018 to be the entity responsible for implementing tax laws. The Authority's responsibilities include the application of tax laws, regulations, and relevant instructions, reviewing and evaluating tax declarations, and collecting taxes from taxpayers.

The Authority also represents Qatar in regional and international organizations and conferences related to taxation and enters into tax agreements with countries around the world to support economic cooperation and encourage joint investments.

The Authority’s five-year strategy aims to improve services for taxpayers by simplifying procedures and providing user-friendly digital platforms to enhance tax compliance. The Authority also seeks to enhance oversight by utilizing data and risk analysis, expanding electronic audits, and implementing real-time monitoring.

The Authority aims to become a national center for economic data by developing a comprehensive database and supporting national policies through regular reports. It focuses on enhancing operational efficiency through digital transformation and automating processes using artificial intelligence.

The Authority is committed to developing high-performance human resources through professional training programs and opportunities to develop future leadership. It also works to enhance transparency and trust in the tax system by publishing performance reports, providing guidance manuals, and protecting taxpayer data.

Additionally, the Authority supports business growth and the economy by facilitating compliance procedures and encouraging investment, while promoting collaboration with stakeholders through consultations and awareness initiatives aimed at improving the country’s tax system.

Thank you for subscribing to the newsletter