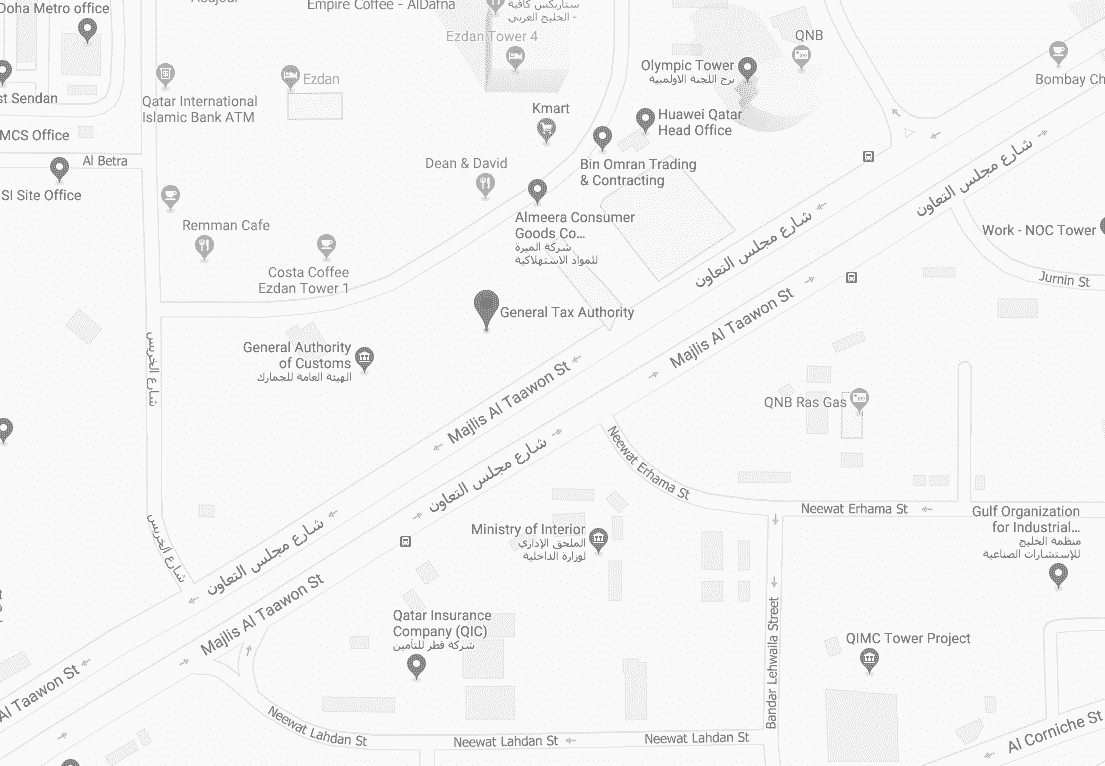

General Tax Authority

General Tax Authority Announces the Deadline for Submitting Tax Returns

The General Tax Authority (GTA) announced that the companies and entities wholly owned by Qataris and other GCC nationals that are exempt from corporate income tax,

and the companies with a non-Qatari partner, shall submit their tax returns for the fiscal year 2021, no later than April 30, 2022. The submission of both "simplified" tax returns and tax returns audited by a certified accounting firm shall be done via Dhareeba tax portal www.dhareeba.qa. All companies shall also attach their final accounts when filing tax returns.

The General Tax Authority called on all Qatari companies to submit their 2021 tax return before April 30 to avoid financial penalties according to the Income Tax Law and its executive regulations, which stipulate that all companies and permanent establishments, wholly owned by Qataris and GCC nationals, exempt from corporate income tax, must submit their tax returns timely.

As part of its endeavors to enhance tax compliance, GTA stresses that all companies must submit their tax returns, adding that the tax system benefits these companies and helps them improve their institutional efficiency, governance, performance, and profitability.

Top Notifications

-

General Tax Authority Announces Tax Return Filing Period for the Financial Year Ended 31 December 2025

31-Dec-2025 -

The General Tax Authority Announces an Extension of the Tax Return Filing Period for the 2024 Fiscal Year

9-Mar-2025 -

The General Tax Authority Announces the Tax Return Filing Dates for the Tax Year Ending December 31, 2024

1-Jan-2025 -

The Arrival of the First Shipment Bearing the "Digital Tax Stamps" Following the Decision to Apply Them in Qatar The Implementation of Digital Tax Stamps on Tobacco Products and its Derivatives

23-Oct-2022 -

General Tax Authority Announces the Deadline for Submitting Tax Returns

3-Apr-2022 -

GTA extends deadline for filing tax returns

30-Aug-2021 -

Deadline for filing tax returns for Qatari companies Aug 31, non-Qatari companies June 30

4-Jun-2021

Thank you for subscribing to the newsletter